"Do what you can, with what you have, where you are." — Theodore Roosevelt

The year 2020 will be remembered for many reasons and key among them will be the COVID-19 pandemic. This pandemic does not discriminate, and its impact reaches across a wide range of geographies and industries. The non-profit world, in particular, has seen revenues shrink and donations dry up as many question, “what’s next?” Just as we could not predict a global pandemic, there is no certainty as to what the next weeks, months, or years may bring and how that may impact non-profit investors. Investing always involves making decisions amidst uncertainty, so it is imperative to build a portfolio that aims to weather all storms. As the quote from Teddy Roosevelt illustrates, sometimes we must embrace what the world gives us.

Pre-pandemic, we maintained the view that the next ten years would not mirror the same strong bull market experienced since the Financial Crisis of 2007 -2008. Our position has been further solidified by the devastating global economic impact of COVID-19. As the global economy continues to struggle it seems counterintuitive that equity markets continually flirt with all-time highs while also approaching historic valuation levels. We seldom know what will happen in the near term, but given the current environment, the consensus belief is that longer term equity returns will be lower. Paired with global fixed income rates near zero and a recent increase in volatility, many investors are confused about how to best position their portfolio for the future.

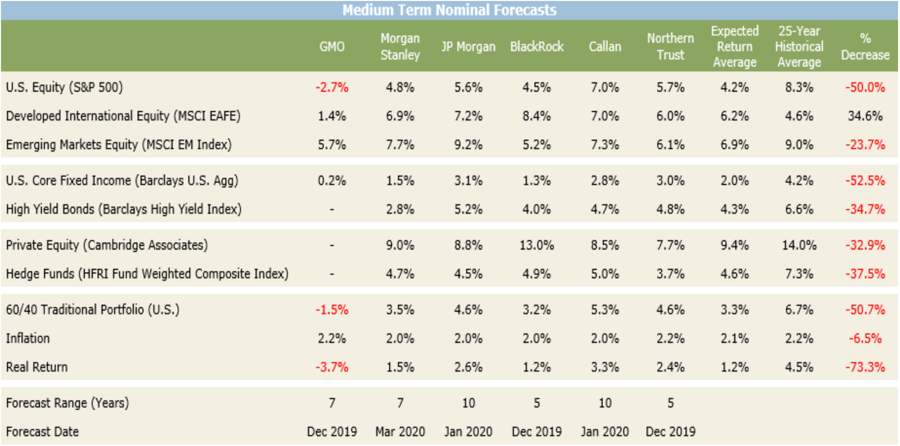

The chart below illustrates capital market assumptions forecasted by six of the largest financial firms. Compared to their 25-year historical averages, almost all major asset classes are expected to provide significantly lower returns looking forward. The story is clear: the same 60/40 portfolio that many investors relied upon in the past may not be well-suited to carry them into the future.

Sources: Capital Market Assumption reports from each respective firm; asset class performance and inflation data sourced from Bloomberg

The case presented in the chart seems grim. Overvalued markets and lower expected returns paired with the growing uncertainty of future revenue streams and operational expenses present non-profits with a serious dilemma. At a time when these institutions depend most on the distributions from their investment portfolios, the ability to achieve their long-term return targets and support these distributions may be significantly impaired. Staying the course all but guarantees below target returns and the erosion of principal while return or yield seeking behavior may require the acceptance of outsized risk. So, what is a non-profit investor to do?

While no one has a crystal ball (at least not one that has been proven to predict capital markets), we believe the answer lies in undertaking the following key actions:

- Stay calm and avoid big tactical bets. This may be the most espoused advice for investors during the recent pandemic, but it is one that holds a lot of merit, particularly for non-profit investors focused on the long-term.

- Reevaluate your risk tolerance and return expectations in context of evolving liabilities. Stressors like the pandemic can serve as an accelerant for existing challenges and an open invitation for new operational strain. Institutions must ask themselves how much they would be willing or able to lose to determine how much risk they can sensibly take moving forward.

- Review your investment policy and asset allocation targets. Strategic diversification is increasingly important in the current zero rate environment as investors seek out alternative sources of return and alpha. Non-profit investors should seek to benefit from an asset allocation that not only improves return-to-risk ratios, but also provides resiliency, protection, and liquidity in down markets when these organizations need them most.

- Get the right people in your corner. As markets continue to evolve, the ability to take advantage of new opportunities may be best sourced through regular, proactive oversight of your investment portfolio. It is important to ensure you have the right fiduciary partners in place to guide your institution into the future and dynamically respond to its specific needs.

This list is short, but these recommendations are far from simple. We encourage non-profits to collaborate, share ideas, and seek out guidance so they may face these challenges and best position themselves to achieve their goals in perpetuity. Our communities depend on the impact of our non-profit institutions today, more than ever.

Our mission at Verger is to invest in the lives of others. That means supporting the needs of organizations who are dedicated to improving lives and providing opportunity, regardless of whether they are a client. We welcome further questions and discussion, and we would be happy to share additional resources, including a template due diligence questionnaire should your organization find itself searching for an investment advisor.

This communication is for general informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security or a guarantee of future results. This article also does not constitute an offer to sell or a solicitation of an offer to buy interests in any particular security, including interests in any Verger investment vehicle. This article may include “forward-looking statements,” such as information about possible or assumed investment returns or general economic conditions. Actual results may differ materially from the information included in this article and no information in this article will be updated to reflect actual results or changes in expectations.